Irs rental property depreciation calculator

By convention most US. The IRS considers the useful life of a rental property to be 275 years so the amount of depreciation you can claim each year is your propertys value divided by 275.

Rental Property Depreciation Rules Schedule Recapture

Calculate depreciation for any chosen period and create a sum.

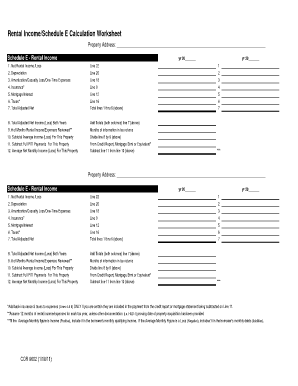

. So if you did not depreciate in past years you can still amend the last 3 years tax returns 2018 2017 and 2016 to claim that depreciation. If you have more than three rental or royalty properties complete and attach as many Schedules E as are needed to separately list all of the properties. Net rental real estate income or loss Lines 2 and 3.

Amortization or a non-recurring Casualty Loss. Catch-up depreciation is an adjustment to correct improper depreciation. Depreciation commences as soon as the property is placed in service or available to use as a rental.

Then it automatically calculates depreciation for either residential or commercial rental properties based on the users choice. It and its new floor coverings and appliances have been depreciated for 2 tax years. Read more about rental property depreciation before writing it off and use our rental property depreciation calculator to make your life easier.

But what about the other assets. 10-year property 15-year property 20-year property 25-year property 275. List your total income expenses and depreciation for each rental property.

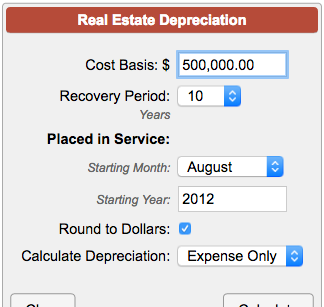

The math is a bit more complex than well want to dive into here but to get a ballpark of your expenses you can enter the cost of your property and other variables into a property depreciation. The concept of depreciation for an asset is to spread the cost of using the asset over a number of years the assets useful life by. The depreciation methods discussed in this publi-cation generally do not apply to property placed in service before 1987.

Sum-of-Years Digits Depreciation Calculator. IRS advance rent must also be reported under gross income. IRS Section 121 allows people to exclude up to 250000 of the profits from the sale of their.

Uses mid month convention and straight-line depreciation for recovery periods of 22 275 315 39 or 40 years. Form 91 Income Calculations. Including the depreciation you did not deduct.

Claiming catch-up depreciation is a change in the accounting method. Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. For more information see Pub.

Use a Rental Property Calculator. W-2 Income from self-employment reported on IRS. Be sure to enter the number of fair rental and personal-use days on line 2.

The IRS made it much easier and safer to take this deduction if you use their Simple method for calculating the deduction. Calculate ROI return-on-investment before and after taxes. Property depreciation for real estate related to MACRS.

You didnt claim depreciation in prior years on a depreciable asset. Free MACRS depreciation calculator with schedules. You claimed more or less than the allowable depreciation on a depreciable asset.

534 Depreciating Property Placed in Service Before 1987. Passenger automobiles as. Depreciation IRS Form 1065 Line 16c Only add back the eligible Other line items such as.

For instance if a tenant pays first and last months rent the entire amount should be listed on your tax return. Listed property is any of the following. I inherited a rental property that was being depreciated.

Selling a home you live in is more tax beneficial than unloading a rental property for a profit. IRS Depreciation Guidelines - This is a helpful article provided by the IRS that answers many questions. They were being depreciated with a.

Supports Qualified property vehicle maximums 100 bonus safe harbor rules. The IRS set up Section 179 deductions to help businesses by allowing them to take a depreciation deduction for certain business assetslike machinery equipment and vehiclesin the first year these assets are placed in service. This is a coveted tax deduction because depreciation isnt a real cash expense.

Rental Property Calculator - This rental property calculator lets you enter all your financial projections. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating. Calculator and Quick Reference Guide.

Stead of depreciation deductions for certain property and the additional rules for listed property. If you did not when you sell your rental home the IRS requires that you recapture all allowable depreciation to be taxed ie. Calculate depreciation and create a depreciation schedule for residential rental or nonresidential real property related to IRS form 4562.

Residential rental property is depreciated at a rate of 3636 each. Adheres to IRS Pub. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis.

Macrs Depreciation Calculator With Formula Nerd Counter

Guide To The Macrs Depreciation Method Chamber Of Commerce

Macrs Depreciation Calculator With Formula Nerd Counter

Residential Rental Property Depreciation Calculation Depreciation Guru

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Macrs Depreciation Calculator Irs Publication 946

Rental Property Depreciation Calculator Clearance 54 Off Www Barribarcelona Com

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Based On Irs Publication 946

How To Calculate Depreciation On A Rental Property

Rental Property Depreciation Rules Schedule Recapture

Residential Rental Property Depreciation Calculator

Macrs Depreciation Calculator Irs Publication 946

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Depreciation On Rental Property

Macrs Depreciation Calculator With Formula Nerd Counter