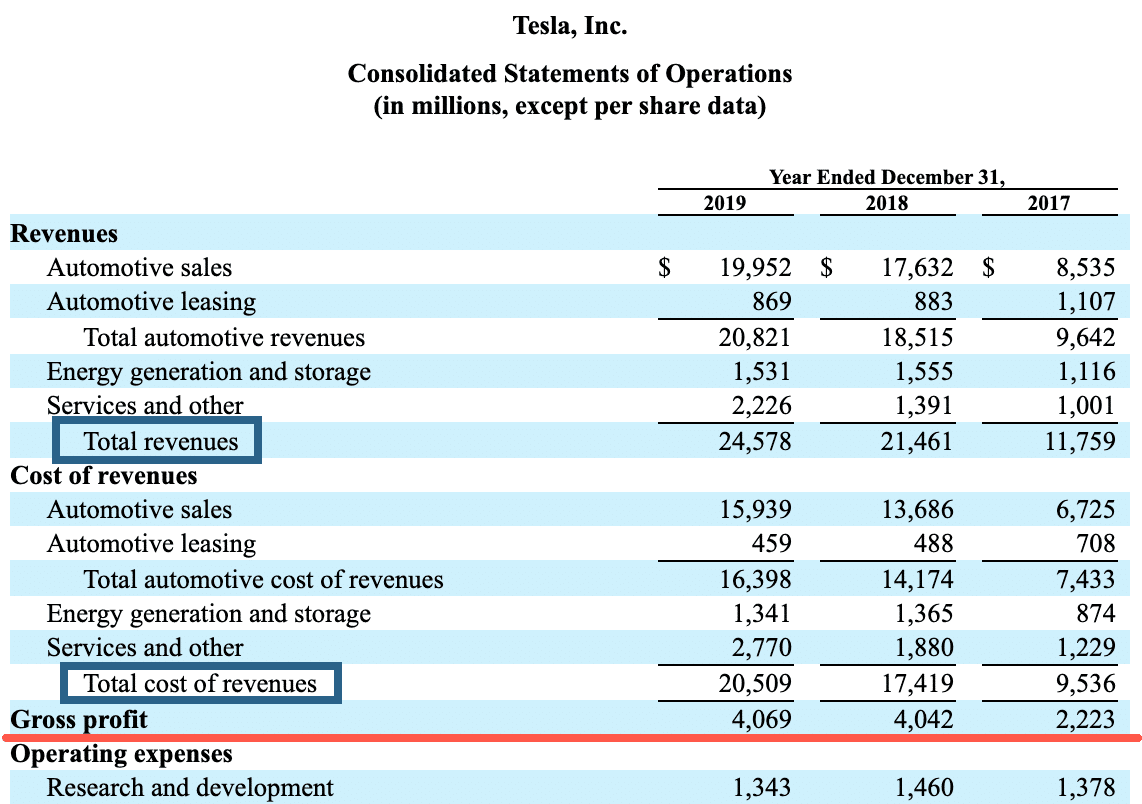

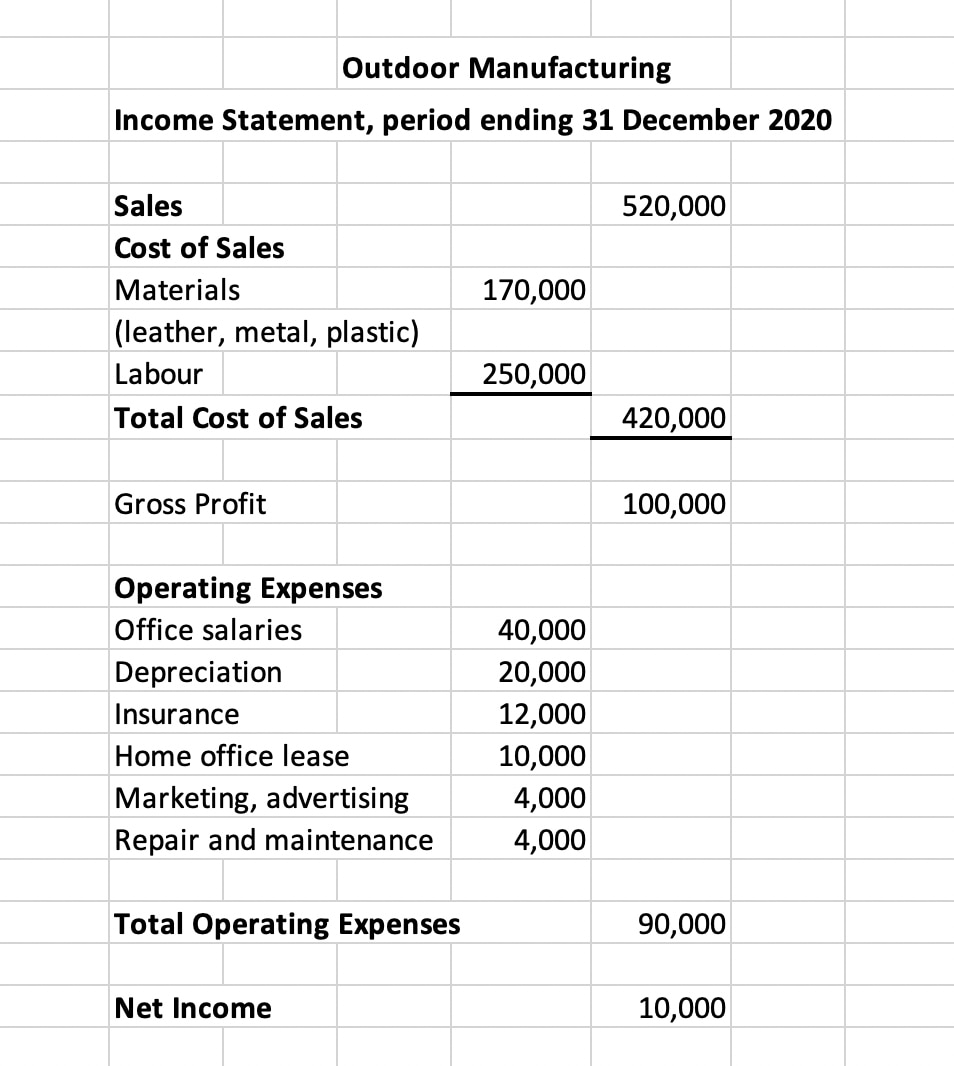

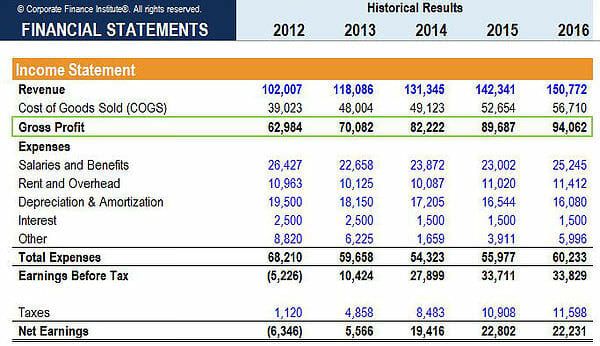

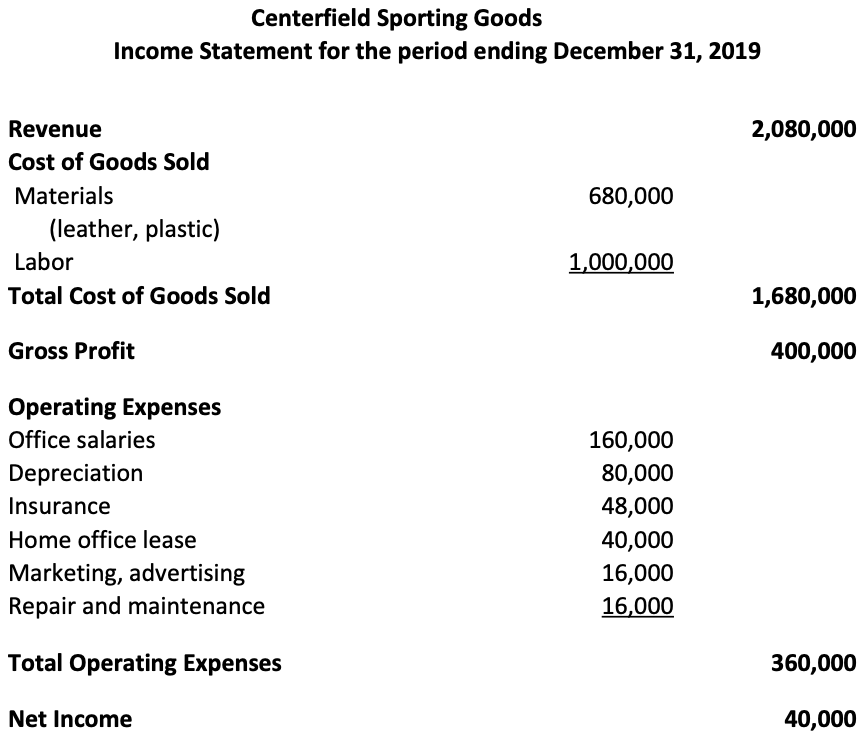

Computation of gross profit

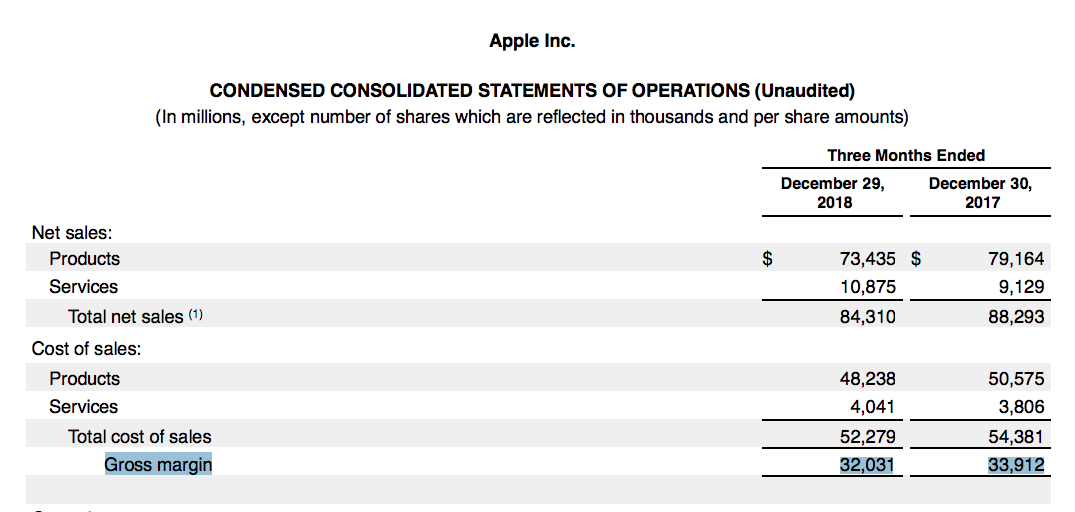

Gross profit is a metric used to determine how effective a company is at manufacturing and delivering its products andor services. Gross Profit Sales Gross Profit Margin.

Gross Profit Margin Vs Net Profit Margin Formula

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services.

. Gross Profit Revenue - Cost of Goods Sold. Gross Profit 880. Concepts of gross profit help the management in creating the budgets and future forecasting.

Cost of Goods Sold 080 x 400. The gross profit margin is a good way to measure your businesss production efficiency over time. Lets look at the gross profit of ABC Clothing Inc.

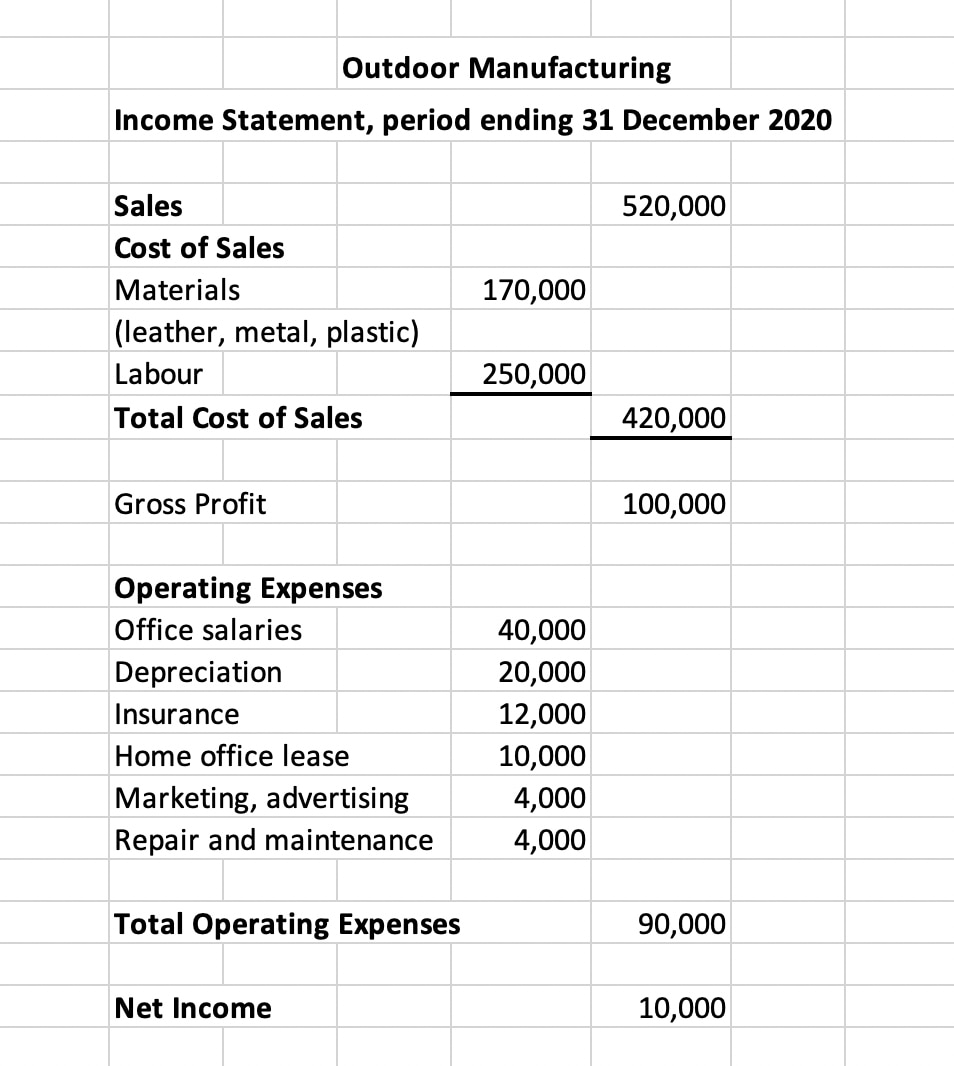

Gross Profit is one of the items appearing in the income statement of a business. First you can increase your prices. Second you can decrease the.

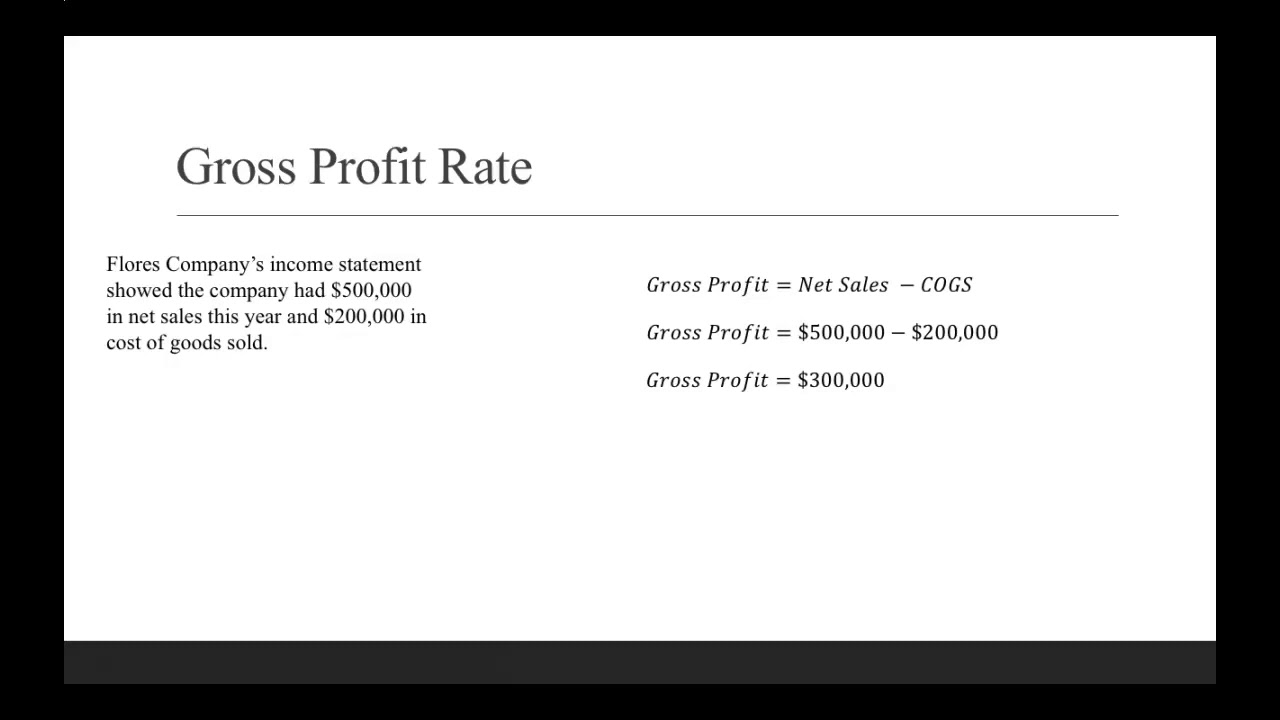

That is the Gross Profit figure. This article explains with the help of an example what is gross profit. Gross Profit Margin 500000.

Using the above gross profit. 1 Whereas gross profit is a dollar amount the gross profit margin is a percentage. Even the investors get help in comparison of profits or margins of two different.

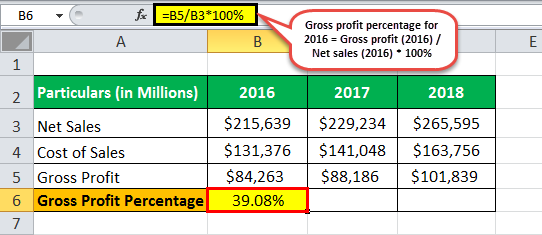

The computations of Gross Profit shall be prepared by the Chief Financial Officer of Buyer who shall certify that computations were prepared in accordance. You can multiply the resulting number by 100 for a percentage. This gives you the gross profit percent which you can evaluate to determine profitability.

Gross Profit Margin Revenue Cost of Goods Sold Revenue. Computation of Gross Profit 1. Two Simple StepsStep 1.

There are two key ways for you to improve your gross margin. As an example of the computation of gross profit margin. The gross profit margin calculation can be done manually by first taking the total revenue or total sales of the company and then subtracting the cost of goods sold COGS to arrive at the gross.

Using the example retail company apply the formula when the gross profit is. This module is divided into two lessons. Lesson 1 Compute for profits.

Gross Profit 1200 - 320. Figure out Gross ProfitResale - Cost Gross Profit12 resale - 7 cost 5 Gross ProfitStep 2. If these represent all of our revenue sources we can say that our total income is P20000 P7000 P3000 P30000.

The higher the gross profit the. Computation of Gross Profit. Cost of Goods Sold 320.

As a consequence since there exists closing stock at Ms Verma Traders during the end of the accounting period this will change Gross Profit. For Year One sales were 1 million and the gross profit. 5 CO_Q2_Entrepreneurship SHS Module 8 The ultimate goal of any business whether a retail or wholesale is to earn a profit.

Getting the difference between. Divide Gross Profit by Resaleand multiply times 100 to get the. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after.

Gross Profit Percentage Double Entry Bookkeeping

Calculating The Gross Profit Rate Youtube

Gross Profit What Is It And What It Means For Your Business Bench Accounting

Gross Profit Percentage Formula Calculate Gross Profit Percentage

What Is Gross Profit Definition Formula And Calculation Stock Analysis

How To Calculate Gross Profit Margin And Net Profit Margin

Gross Margin Definition For B2b Saas Kpi Sense

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is The Gross Profit Margin Bdc Ca

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Gross Profit Margin Vs Net Profit Margin Formula

Gross Profit Margin Formula And Calculator Excel Template

Gross Profit Essentials You Need To Know About Gross Profit

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is Gross Margin And How To Calculate It Article